The debate over how to treat water—as a public resource or an investment tool—is escalating as climate change accelerates the water crisis in the West.

The debate over how to treat water—as a public resource or an investment tool—is escalating as climate change accelerates the water crisis in the West.

August 10, 2022

Illustration by Sarah Gilman.

This article is part of our series of in-depth investigations. Got a tip? Please contact us on our secure email at civileats-at-protonmail.com.

Michael Jones ducked under an idle sprinkler and strode across the sandy soil where he planned to plant drought-resistant crops, hoping to save water amid the driest period in more than 1,200 years.

For the fourth-generation grower, sowing fewer, higher-value plants on this tiny organic farm was borne out of necessity: In 2018, his irrigation ditches ran dry. Farmers in Colorado’s San Luis Valley rely on such ditches, which are fed by snowmelt and rain that run into cottonwood lined creeks that flow out of two towering mountain ranges, the Sangre de Cristos and the San Juans. But that snowmelt dropped by 40 percent over the last four decades. The six-county region is now among the harshest places to farm in the West. Federal officials designated it a disaster area in April due to its extremely arid conditions.

“We have a saying in the West that ‘water flows uphill toward money.’”

“The water table on my well is at 42 feet,” Jones said recently as he sat at the kitchen table in his family’s renovated adobe home. “When we were kids, we could dig to water before lunch pretty easily and wells that pumped 1,000 gallons a minute to start the season now only produce half that.”

After five years of scraping by, Jones and his wife, Sarah, are looking forward to a season shaped by greater demand for their potatoes, rye, canola, peas, and other crops that will allow them to make enough money to meet their needs. Yet this tenuous success may be in peril. A company known as Renewable Water Resources (RWR) aims to drill a series of deep wells on a nearby ranch it owns and pipe the water more than 200 miles north to a Denver suburb, where sprinklers rotate on manicured lawns.

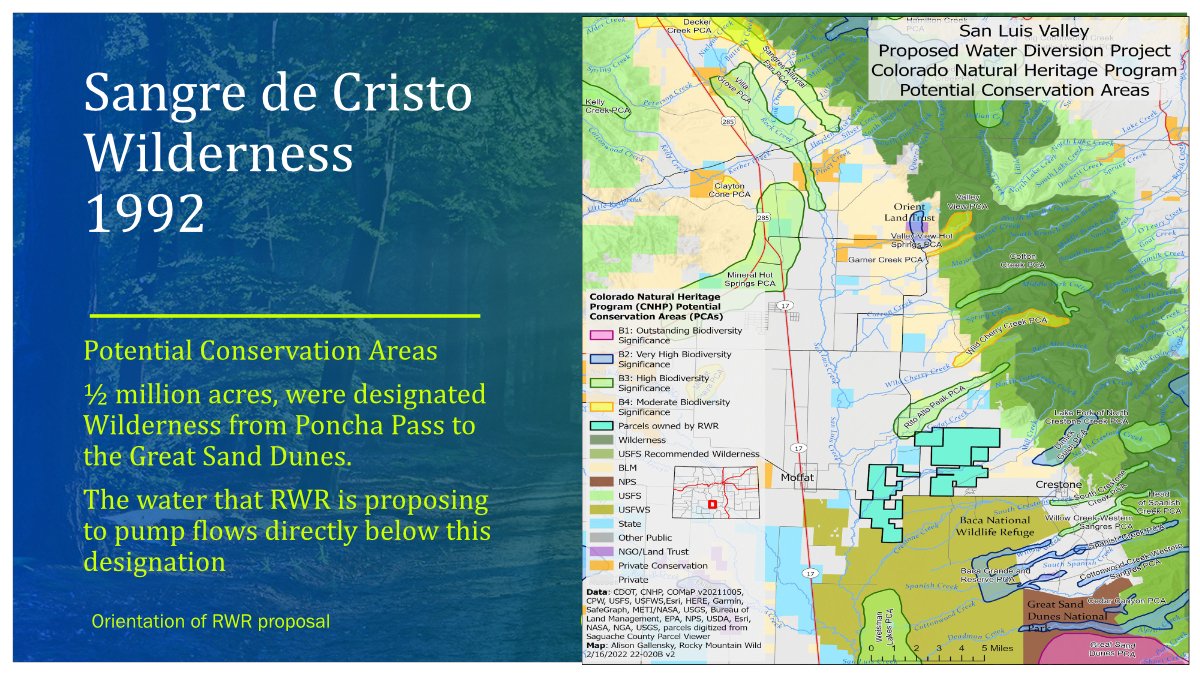

A map of the Sangre de Cristo Wilderness, illustrating the water diversion project that RWR is proposing. (Click for a larger version)

The firm recently sought $10 million from Douglas County to kickstart its project. Now, trucks across the Massachusetts-sized valley sport bumper-stickers in opposition; there’s even a hostile marquee. Urban leaders anxious about their own dwindling water supply to the north, some of whom have accepted campaign contributions from the company’s principals—a group of well-to-do businessmen that includes a former governor—have expressed ongoing interest in working with RWR on its plan.

If the state engineer’s office, its water court, and federal regulators were to approve RWR’s plan, it would mark the first time that private investors could ship water from an aquifer in one part of the state to a community in another. Yet the potential to profit from piping the scant resource to the rapidly expanding cities east of the Rocky Mountains is increasingly attractive to investors as drought and shortages drive up the price of water and Colorado’s population is expected to double by 2040.

It’s a scenario that will test Colorado’s ability to balance water use between its agriculture industry—whose 38,900 farms and ranches generate about $47 billion a year in economic impact—and rapid population growth.

To proceed, RWR must purchase water rights from farmers and ranchers, many descendants of families who settled Colorado’s oldest agricultural region in the mid-1800s.

Meanwhile, farmers and ranchers who share the 8,000-square-mile valley with RWR have already been tilling less ground, fallowing land, and using less water-intensive crops in a race to meet a state-mandated 2030 deadline to restore water to shrinking aquifers or face well shutdowns.

Selling their water to RWR, a practice known as “buy and dry,” would force farmers to grow even less and could have cascading effects on a region that reaps the nation’s second-largest potato crop. Such transactions have previously been politically unpopular and discouraged in the state’s water plan, in part because they can devastate local economies and ecosystems. Wildlife is also suffering as water supplies shrink: Biologists move threatened fish in buckets from creek to creek. Nesting birds on one of three national wildlife refuges in the valley almost ran out of water recently until state and local officials scrambled to find alternative sources.

However, the valley’s climate crisis hasn’t stopped RWR—which is backed by private investors, attorneys, and lobbyists and has ties to an investment firm with purportedly more than $100 million in assets, Zeppelin Partners, LLC—from asking commissioners in Douglas County to buy the water RWR says it has already started to acquire. (By law, the firm must make an agreement with an end user before it can present a plan in water court, a critical step along its path to becoming a water-dispensing intermediary.)

The proposal pits some of the state’s poorest residents against some of its most well off, raising equity issues emblematic of those faced by communities across the West as they determine how to best share water in a new age of scarcity. And it’s one of a number of efforts to treat the system of water distribution as a new kind of marketplace.

“We have a saying in the West that ‘water flows uphill toward money,’” said Peter Gleick, a senior fellow at the global water think tank The Pacific Institute. “That is true if our laws and water rights rules permit farmers to sell water. Then these kinds of transfers, which were very common in the 20th century, are going to continue. And they are not going to solve our water problems, they’re going to change where they are most severe.”

Water has always been in short supply in much of the arid West. Now, the worst drought in more than a millennium, combined with a boom in new subdivisions, mini malls, and big box stores, is stretching the precious resource to the breaking point.

The West was built by moving water around. Historically, utilities or municipalities have purchased water from farmers and ranchers to serve residential and business customers. Those farmers and ranchers hold some of the most senior water rights and, in most states, consume up to 80 percent of the available water.

In Colorado, more than two dozen trans-basin diversions send surface water from one region to another, mostly from the Western Slope of the Rocky Mountains to the eastern side, where nine out of 10 of the state’s residents live. This system is increasingly under strain as the snowmelt that feeds rivers shrinks and more people move to the Denver region. If solutions aren’t found to better conserve and share this water, researchers warn, the state risks losing “700,000 acres of currently irrigated farmland” supporting commodity crops like alfalfa, corn, wheat, sorghum, and millet.

Also being squeezed are the state’s overtapped aquifers. The groundwater Douglas County relies on is not renewable, something the state engineer’s office frequently reminds well users about. RWR seeks to capitalize on this message with its own: “Douglas County’s current ‘patchwork’ system of compiling water in small amounts is not working,” reads one proposal to the three-member county commission.

The company’s principals, who said in a public meeting that their proposal is “not speculative,” did not respond to requests for comment by phone and text, or answer detailed questions sent by e-mail. A visit to offices listed on business filings turned up dusty desks in an industrial park and a vacant glass-walled office in a shared workspace near downtown Denver.

RWR’s plan is one of several controversial plays by investors in the West who view water as a money-making opportunity and are eager to act as middlemen between farmers and water providers.

The debate over how to treat water—as a commodity that can be bought or sold on the market like gold, corn, or oil, or a public resource that should not be available to investment markets—is escalating as climate change accelerates the water crisis in the West.

“Speculators buy water rights and they just hold them and there’s no record of it…The neighbors don’t like it, but people keep their mouth shut about it, and it’s not highly publicized and there’s not any way to track these deals.”

Water now trades on the Chicago Mercantile Exchange, with proponents saying that treating water as a commodity could help mitigate future water crises. Private investors are also buying up water rights in a bet on escalating prices.

In one scenario, the New York-based hedge fund Water Asset Management (WAM) spent more than $16 million to acquire 2,000 acres of farmland on the Western Slope of Colorado’s Rockies. It’s now positioned to harvest water by fallowing ground on properties it owns. Its executives say it could store the water saved in Lake Mead and Lake Powell. Though Lake Powell fell to its lowest level on record in May, forcing federal regulators to hold back water releases to Arizona, California, and Nevada, WAM has invested more than $300 million in water-rich farms in these states.

These types of acquisitions drew the attention of California state legislators, who asked Attorney General Merrick Garland “to investigate anti-competitive practices in water rights purchasing and potential drought profiteering in western states.”

The United Nations has also warned that futures markets elsewhere could exacerbate inequity while speculators drive up the value of water. The opaque system of ownership also makes many nervous about unknown impacts for ratepayers and the environment.

“Speculators buy water rights and they just hold them and there’s no record of it,” said Peter Nichols, a partner at Berg Hill Greenleaf Ruscitti, LLP, who specializes in water law. “The neighbors don’t like it, but people keep their mouth shut about it, and it’s not highly publicized and there’s not any way to track these deals.”

With more headwaters than any other state, Colorado is on the leading edge of experiments to develop such water markets. The emerging practice is in direct conflict with the historic means by which water rights have been distributed in the West. These rules gave away water to settlers on a first-come, first-served basis known as “first in time, first in right.” But ultimately over the last 150 years, regulators distributed far more water than exists.

“The way we have given away water in the West isn’t working,” said Gleick. “I consider water markets to be a small part of the comprehensive set of changes we need to make,” he added. “We need to revamp water rights, but politically and legally that is the most difficult thing to do.”

One of the world’s largest philanthropies, with a history of using its money to privatize natural resources and social systems, The Walton Family Foundation, spent about $200 million over the last decade to guide planning and research toward a market-based approach, a Wall Street Journal analysis found.

RWR’s export proposal has reignited a long-standing debate over how to balance producers’ private property rights and prevent profiteering off the dwindling resource.

The foundation, established by Walmart founders Sam and Helen Walton, spreads grant money among activists, the media, and universities, often expecting support for their positions in return, said Gary Wockner, whose nonprofit, Save the Colorado, received its grants from 2011 to 2014. “It’s like they fund all the environmental groups and half the media, and now they fund the scientists. And one of their staffers—Tanya Trujillo—was just pegged by President Biden to be the main person who sets water policy for the Bureau of Reclamation.” He called Trujillo an “architect” of the Walton’s water market policy.

The San Luis Valley, is home both to the wettest part of the state—Wolf Creek Pass, which can receive up to 400 inches of snow in winter—and the driest, Center, which averages just seven inches of rain a year. It is also Colorado’s oldest agricultural community, which makes its farmers the keepers of the state’s most lucrative water rights.

To nurture crops in this high desert, Spanish settlers relied on ancient irrigation ditches, known as acequias. They brought the technique to Colorado’s oldest town, San Luis, in the 1850s, where they filed for the state’s first water right.

Settlers from across the country followed and also dug ditches, which they connected to creeks coming off mountains and lined with metal head gates to control the flow of water. When stream water declined as the climate warmed, farmers and ranchers tapped the region’s two aquifers.

Now, the valley’s economy and unique federally protected ecosystems are reliant on ever-complicated ways of moving water around, ways that are failing. Water withdrawn by wells exceeds the amount of snowmelt refilling aquifers and there are more claims to water rights than there is water in streams. Over time, state regulators and regional water managers have put in place a suite of conservation measures. Yet even after producers cut pumping by a third, water in the upper aquifer fell to its lowest level on record earlier this year.

Scarcity isn’t new, but RWR’s export proposal has reignited a long-standing debate over how to balance producers’ private property rights and prevent profiteering off the dwindling resource. Many farmers and ranchers consider water rights their retirement fund and bristle at anyone telling them they cannot sell them. Former Governor Bill Owens, an RWR principal, has capitalized on the sentiment, writing in a recent op-ed in Colorado Politics, “Water rights are just as much private property as a person’s ranch, livestock, or family home.”

Finding this balance has proved thorny for Colorado state legislators, who failed in 2021 to reach an agreement about how to strengthen anti-speculation law. Lawmakers in May also tabled a bill drafted with feedback from numerous hearings about speculation following pressure from producers who were adamant that their right to sell their water not be curtailed. The conversation is so fraught, that Douglas County Commissioners said in a public meeting that some farmers approached them saying they wanted to work with RWR, but were unwilling to say so publicly.

“Trying to farm within our water restrictions means changing how you grow, what you grow, and when you grow it.”

Much is at stake. Agriculture contributes up to $435 million to the San Luis Valley’s economy annually. Imperiled wetlands here also support 360 bird species, including migrating Sandhill cranes with wingspans as long as Shaquille O’Neal is tall. Unique ecosystems at the Great Sand Dunes National Park and Baca National Wildlife Refuge also depend on the region’s vulnerable hydrologic system.

“It’s approaching the point of a real economic and cultural crisis in our community,” said Cleave Simpson, a state senator, fourth-generation farmer and rancher, and general manager of the Rio Grande Water Conservation District. “About 168,000 irrigated acres are at risk . . . if we can’t solve this.”

RWR’s proposal to withdraw more water complicates officials’ efforts to restore water to the Rio Grande River to meet delivery obligations to New Mexico, Texas, and Mexico. Thousands of acres have already been allowed to dry up and farmers who pump water pay a fee to compensate producers who fallow land in attempts to return rivers and aquifers to sustainability.

“This is unheard of in the West,” said Greg Peterson, executive director of Colorado Agriculture Water Alliance, during a February county commissioner study session on the RWR proposal. “Less water and less acreage is less income.”

The fact that other buy and dry deals between municipalities and farmers and ranchers have already led to economic and environmental disaster for California’s Owens Valley and Colorado’s Crowley County is a concern. After the water was gone in Crowley County, farms dried up, causing support businesses like equipment dealers, restaurants, and gas stations to go belly up and leading to steep declines in tax revenue, which impacted schools, law enforcement, and other services.

“You always have to be careful of the unintended consequences of some of these experiments,” said Lisa Dilling, a professor of environmental studies at the University of Colorado Boulder, and co-author of a paper that found that “Crowley County proved a tragic but useful lesson . . . for how bad it can get.”

“I think this is where communities need to be listened to—they need to be brought into the process,” she added.

San Luis Valley residents say Douglas County Commissioners failed in this regard when they canceled a town hall meeting in the valley to hear testimony on the RWR proposal in early spring. The decision came after residents spent weeks arranging meetings for commissioners with local officials. In a statement, the board said it took the action after it, “Became convinced from social media postings that a ‘protest’ was being staged instead of the open dialogue with which they welcomed Valley guests when they visited Douglas County.”

Young farmers in the Valley, like the Joneses, are on the cutting edge of a burgeoning movement to help farmers and ranchers remain profitable and ultimately preclude the necessity for them to sell their water.

“Trying to farm within our water restrictions means changing how you grow, what you grow, and when you grow it,” Michael Jones said as he stood near a motley collection of rusting, castoff farm equipment he had refurbished. “We went from farming whole circles, to farming half circles, and now quarter circles. If we can’t get more value off of these crops, then it’s not going to work.”

To make money, they are negotiating contracts with customers like Whole Foods and Amy’s Kitchen. They are experimenting with many other crops, such as safflower, for high-end cooking oil. They reimagined the idea of cover crops—selling off-season rye to distillers to use for whiskey. The enterprising couple also works with award-winning chefs to incorporate their produce into restaurant menus.

Meanwhile nonprofits, some backed by the Walton family, are forging flexible water sharing agreements with producers aiming to replenish rivers. Such “market-based environmentalism” is a way to preserve agriculture, ecosystems, and municipal economies rooted in water-based recreation as climate change intensifies, said Andy Schultheiss, executive director of the Colorado Water Trust.

The Walton Family Foundation referred Civil Eats to the trust, which is considered a thought leader on the future of water and has been substantially supported by Walton grants since at least 2009, paying for staff, office space, and to develop water markets. It does so by leasing water rights from farmers and ranchers and returning the water to reservoirs and streams—ostensibly to benefit the environment and recreational uses. The trust has also permanently acquired water rights worth at least $624,650.

“To us, water markets represent the idea that if water rights are easily transferable, at least short term, that it will be easier for water to be shared across different uses in Colorado and shared in a nimble way, quickly, with compensation. That’s always been hard because there is so much friction in the market,” Schultheiss said.

He added that his organization is wary of water speculation, which is against Colorado law, and he rejects claims that the trust keeps water in streams so it can flow out of state, saying that lease agreements return water to a few miles of stream in various parts of the state “before it gets picked up by someone else.”

“Once climate change really digs in hard, there’s going to be very little option other than water sharing. We expect this to pick up a lot,” he added.

“We own and control a decent amount of water rights already.”

In the San Luis Valley, climate change is already digging in hard. The region’s streams and aquifers have been so depleted that state legislators approved a $60 million fund this year in part to buy and retire wells in the Rio Grande basin to buttress groundwater levels.

Legislators hope the effort will save a circular agricultural economy on which the valley’s livelihood depends. This interconnectedness helped the valley’s 46,000 residents defeat three other proposals by private investors looking to profit off their water over the last three decades, prevailing both in court and in public processes.

For example, Jones Farms’ Rouge De Bordeaux grain is ground into flour by Mountain Mama Milling, co-founded by Suzanne Gosar and her late husband, Greg, and now operated by their son. Greg was instrumental in killing a proposal by speculators to transfer water out of the valley to Denver in the early 1990s, Suzanne said. A second water export plan also failed to gain traction later that decade. Suzanne is now embracing the cause.

“When Greg passed away in 2019, I decided to have bumper stickers that read ‘RWR’ with a slash through it produced and to hand them out to everyone at his memorial service,” Suzanne recalled. “I told people, ‘If you don’t put them on your car, just put them someplace people can see them to create a united image against RWR.’”

Today, they’re still visible in a local grocery and landscaping store. RWR has not responded to Civil Eats’ questions about the opposition, despite numerous queries via email and phone.

Forty miles north of the valley’s largest town sits the ranch where RWR proposes to sink its wells. Douglas County commissioner Abe Laydon, who visited in May, said he met privately with company executives and farmers who said they were willing to sell their water rights. RWR said it has hosted 200 such events across the valley, but residents interviewed for this story dispute that number.

Sean Tonner—an RWR principal, lobbyist, and former deputy chief of staff for Governor Owens—told commissioners at a February work session that the company would spend $68 million on water rights and provide $50 million to diversify the economy and expand public services in the San Luis Valley if its proposal were approved.

“The status quo resulted in net migration out of the valley, poverty rates going up, and an almost singular economy,” Tonner said. “The reality is the Front Range is short of water and the San Luis Valley is short of resources. I believe we can come together and get a solution for both communities.”

Tonner told lawmakers, “We own and control a decent amount of water rights already.” He added the firm would not only replace water it pumps from a deep aquifer with an equal amount, but add water by retiring more rights than state law requires. RWR principals contend this aquifer is far larger than water managers believe.

Commissioners voted recently not to allocate $10 million in American Rescue Plan Act funds requested by RWR, however, citing “enormous hurdles” to implementing the plan listed in a set of redacted legal memos. Attorneys who authored the memos found no water that wasn’t already assigned for use to someone else in one of the region’s two aquifers that RWR proposed to tap. The attorneys also wrote that it isn’t achievable for RWR to replace the water it takes from the aquifer with an equal amount, something required by law, even if RWR acquired and retired all the wells in the area.

“We are confident in our ability to mitigate any areas of concern.”

The proposal also likely would require an environmental review to ensure it wouldn’t impact the Great Sand Dunes National Park, they wrote. Congress expanded the federally protected area on which the dunes sit and made it a national park in 2004 to guard its aquifers from speculators. The memos also cited opposition to RWR’s plan from Colorado Governor Jared Polis, Attorney General Phil Weiser, and U.S. Senators Michael Bennet and John Hickenlooper, both Democrats.

Even so, two of the three-member commission encouraged RWR to address issues raised in the memos and reintroduce a modified proposal.

“I’m very much in favor of directing staff to continue to work with RWR—with the goal of actually completing a public-private partnership,” said Commissioner George Teal. Teal, who is one of three commissioners on the Douglas County board, has long supported proposals from RWR, and in 2020 and 2021, accepted thousands of dollars in campaign contributions from RWR principals.

In a statement, RWR said it is “pleased and encouraged to engage in further dialogue with Douglas County . . . Our team is eager to address the County’s remaining questions as raised in the legal analysis. We are confident in our ability to mitigate any areas of concern.”

RWR is revising its proposal as water restrictions in the San Luis Valley are forcing some families to sell livestock, and in some cases entire ranches. And the division between agriculture communities and urban ones isn’t likely to end any time soon.

James Henderson, a fifth-generation producer in the valley and a vice president at the Colorado Farm Bureau, emphasized this point during a February commission work session on the RWR proposal.

“At our Thanksgiving table, I’m the brother that stayed on the farm,” he testified. “My big brother started a business in Douglas County that relies on residential development for its livelihood. Does one brother win and one brother lose? That’s a hard choice.”

October 9, 2024

In this week’s Field Report, MAHA lands on Capitol Hill, climate-friendly farm funding, and more.

October 2, 2024

October 2, 2024

October 1, 2024

September 30, 2024

September 25, 2024

September 25, 2024

Like the story?

Join the conversation.